DAOs - scaling capital coordination

One of the most impactful innovations of the 19th century was the creation of the Limited Liability Company (LLC). The LLC is a business structure which defines that investors can only lose as much money as they have committed.

Prior to the establishment of the LLC, businesses had unlimited liability, which meant that shareholders could be held liable for more than their investment. Partnerships were, as a consequence, the preeminent form of business organization at the time. They were typically composed of small groups of people that knew each other and banded together to mitigate the risks of unlimited liability. While partnerships provided certain protections to business owners, their obvious drawback was that they limited the possibility to raise capital at scale.

Most businesses leading up to the 19th century, however, didn’t require much capital. Those that did, such as the East India Company, could take on external capital with limited liability through a royal charter issued by the government. Governments were, however, at the time stingy in handing out charters.

That changed in the middle of the 19th century with the introduction of the railroad in the UK. Railroads were a cornerstone of the broader Industrial Revolution that brought about signficant gains in GDP but required significant investment. The UK government could no longer constrain the issuance of charters. And so a law was issued in 1855 that made it dramatically cheaper and easier for companies to incorporate as LLCs.

Virtually all companies today are LLCs. In that regard, they have been one of the most important enabling technologies.

The Internet & Blockchains

While the LLC has been incredible in unlocking and commercializing innovation, it has also demonstrated its shortcomings in governing over our digital services. While the large Internet platforms of today have created a lot of value, they have captured the lion’s share themselves and crucially excluded the very people that helped them succeed. The misalignment between companies and their users is an unfortunate cornerstone of the current era of the Internet.

The good news is that Blockchains have provided the tools for a new type of organization that promises to solve for that misalignment.

The onset of the Internet in the 1990s brought about instant and global communication which enabled firms to conduct business globally far more effectively. Blockchains open the set of possibilities for global businesses even further. They allow people from anywhere in the world that don’t need to know or trust each other to transact. Blockchains enable trustless and global value transfer because the trust assumptions needed to do so are coordinated through open source software.

Instant communication coupled with trustless value transfer has given rise to Decentralized Autonomous Organizations (DAOs).

Digitally Native Organizations

To avoid getting distracted by the jargon, a simple way to think of DAOs are as digitally native organizations. They are organizations instantiated entirely through software that can coordinate financial and human capital from anywhere in the world.

DAOs can be seen as the evolution of LLCs in the age of software. As opposed to LLCs they are not legally incorporated because they aren’t tethered to a specific jurisdiction. DAOs exist entirely online which enables them to build out certain advantages over LLCs.

User owned. DAOs are user owned. The asset that expresses ownership of a DAO is its native token, which can either be bought or earned through providing work to the DAO. Tokens, as opposed to the shares of stock granted to owners of an LLC, are a lot cheaper to issue and distribute due to the fact that they are entirely software based.

Companies such as Airbnb and Uber previously tried to distribute shares to homeowners and drivers on their platforms. Existing regulation, however, barred them from doing so. Homeowners and drivers were as a result excluded from participating in the upside of Airbnb and Uber reaching multibillion dollar valuations. The upside was granted to the holders of stock, which were exclusively investors and early employees.

The fact that tokens can be created and distributed seamlessly on the Internet is a defining feature that allows DAOs to have a much more inclusive ownership structure.

Open. DAOs are open organizations that anybody on the Internet can freely enter and exit by either holding or selling their native token. DAO members are not incentivized to work for a DAO through formal work contracts but rather through an incentive to maximise the value of their token holdings.

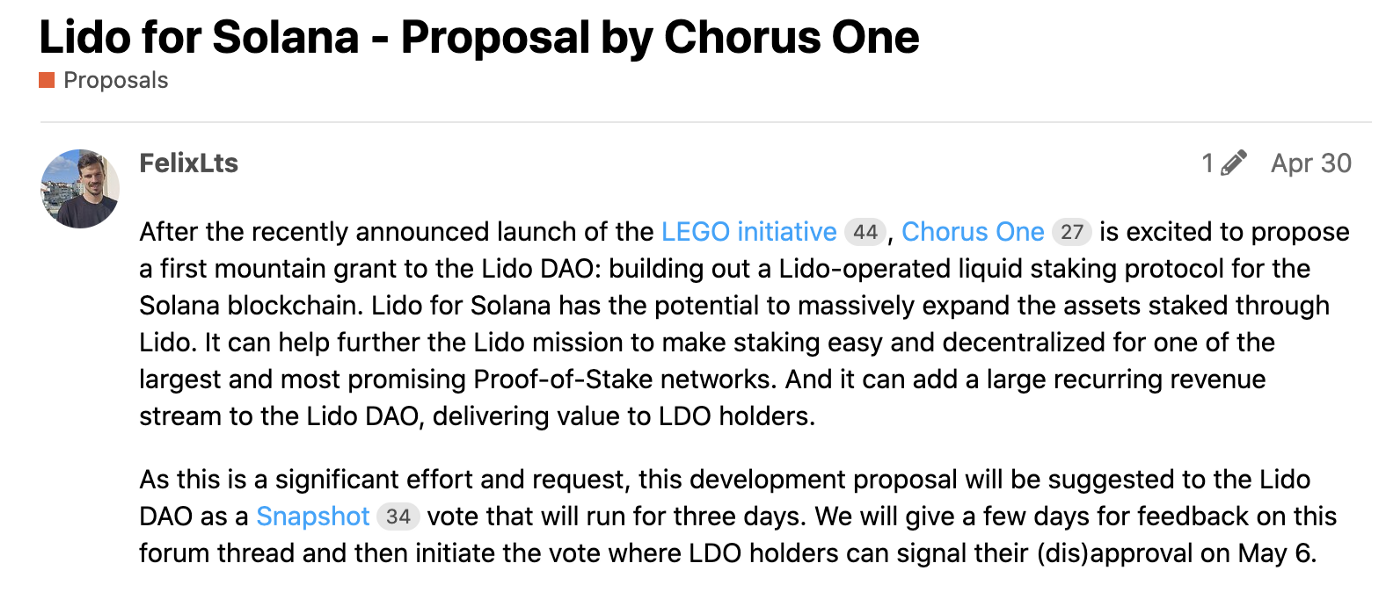

Lido DAO, for example, is a DAO that is building out a staking product across multiple blockchains. It’s native token is the LDO token. The core Lido team built out the first implementation for the Ethereum blockchain. Since then, multiple independent teams that own a share of LDO tokens have built out Lido implementations across other blockchains. The idea is that by building out the Lido footprint and expanding its market share, the tokens will rise in value.

Through open organizational structures and economic incentives, DAOs can pull together resources from all over the world without the necessity of contracts and formal working relationships. This makes DAOs highly capital efficient and allows them to scale to the level of their LLC counterparts at a fraction of the cost.

Digital. DAOs are entirely digital constructs. Contracts of a DAO are written in open source code and enforced through software. This greatly reduces fixed costs and increases leverage for fast scale and wind down. This is a boon for entrepreneurship as startup costs are reduced even further.

Risk symmetry. DAOs ensure that decision makers have skin in the game through token ownership. This ensures risk symmetry whereby owners are not only exposed to the upside, but also to the downside of the decisions they take.

Maker is a lending DAO that allows users to take out credit denominated in DAI by posting ETH as collateral. The programming behind who gets lended to and how much is dictated by Maker token holders. The holders are directly accountable for their decisions. If they govern the DAO well, their assets ideally rise in value when lending activity and customer confidence increases. Conversely, if Maker is governed poorly, consumer confidence and activity falls, which leads to a drop in token prices.

In DAOs there are no arbitrary bailouts that aid in transferring risk. Risk parameters are encoded in open source software.

Own the Internet

DAOs are still early and will continue to evolve. There have been some attempts to tie DAOs to specific jurisdictions and additional legislation will likely come about in an attempt to clarify their legal status. It’s imperative that any legislation doesn’t rein in the ability of DAOs to operate.

DAOs, through leveraging the native properties of the Internet and Blockchains, allow for more scalable and open capital coordination. Just as the LLC has been a catalyst for technological progress, DAOs will arguably have the same lasting impact. They allow for everyone to participate in the value capture of the next phase of the Internet.

Originally published on Medium