Morpho

Lending markets were one of the first decentralized finance (DeFi) primitives to show product-market fit and have consistently ranked amongst the applications with the most traction. A quick glance at total value locked (TVL) across DeFi protocols today reveals that 4 of the top 5 are lending protocols, holding over $50B in assets.

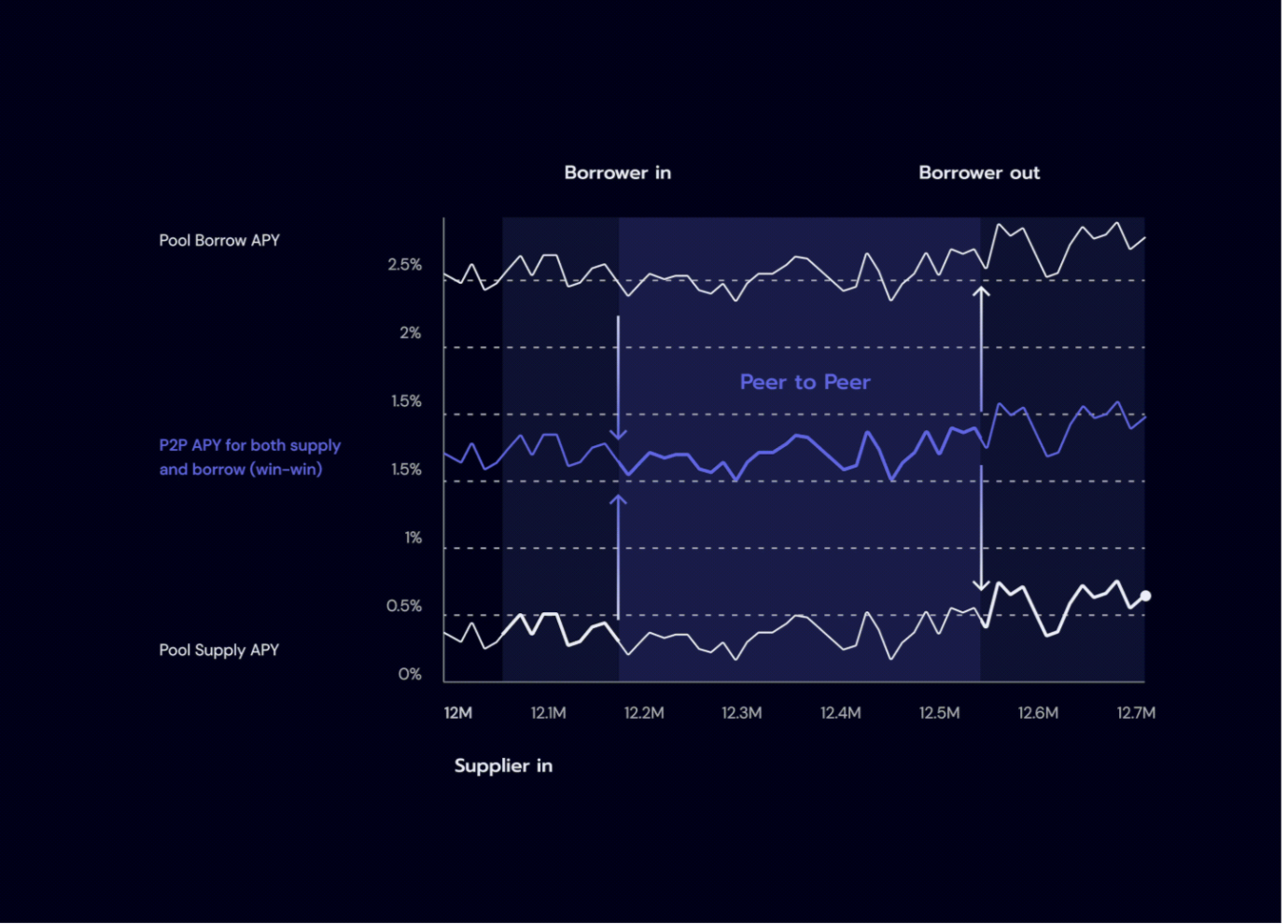

The preeminent lending protocols of today, Compound and Aave, operate on a pool-to-peer model (pool2p). Pool2p models allow lenders to deposit their capital into a pool and borrowers to borrow capital from the pool. Capital in pool2p models is fungible whereby capital supplied by lender A is treated the same as capital supplied by lender B. This fungibility eliminates the cumbersome task of finding matches between lenders and borrowers in the traditional peer-to-peer (peer2p) model, making it easy for borrowers to utilize liquidity and for lenders to constantly earn an annual percentage yield (APY). The downside is the creation of a spread between the borrowing/lending rates — an inefficiency — due to interest payments being shared amongst a larger pool of lenders. That is, individual borrowers pay more interest than what their lending counterparts receive: borrower APY > lender APY.

The first lending protocols built on Ethereum operated peer2p models but ultimately didn’t find success due to the limited user base and liquidity on Ethereum at the time. The space quickly pivoted and found the pool2p model to be incredibly effective at bootstrapping these new lending markets. However, as DeFi and decentralized lending markets mature, the inefficiencies of the pool2p model are becoming apparent. Lenders are unable to compete to offer borrowers more competitive rates and borrowers are left with no choice but to commit to both higher and more volatile interest rates.

Morpho proposes the creation of a new lending market that enables zero-spread loans by automatically matching lenders to borrowers. This new mechanism is composed on top of existing pool2p markets, allowing liquidity that is borrowed from or deposited into Morpho to become fluid in nature. Debt and lending positions automatically move between an underlying pool2p market and a peer2p credit line as counterparties are found or lost. This gives users the best of both worlds: the guarantee of liquidity or yield from a pool2p market and the more optimal rates of a peer2p credit line.

Initially, only the mid-rate of the spread between the borrower and lender APYs will be offered to matched peer2p credit lines. Over time, the team plans to introduce the ability to adjust rates, either directly through the offered APY or via indirect incentives like token streaming, opening up the competitive landscape for decentralized credit lines.

Taking a step back, one can see Morpho as an iteration upon its forbearing pool2p lending markets like Compound and Aave. In traditional web2 businesses, disruption is often characterized by an incumbent quickly losing value to a new entrant. DeFi, however, is anything but traditional. Stemming from its open source and composable nature, future category iterations in DeFi are more likely to symbiotically create value for their upstream predecessors. Morpho is a fantastic example of this phenomenon in action: by leveraging the underlying pool2p markets, Morpho continues to drive usage of their upstream protocols, and in return, is able to bootstrap a peer2p lending market with enough liquidity to offer users a better product from day one.

Morpho’s founding team, Paul, Merlin, Hugo and Mathis, are four young engineers coming out of the Polytechnique Institute of Paris. We’ve been impressed by their community driven approach, articulation of a clear long term vision, and strategic approach to iteratively work towards that vision. The future of France is indeed being built in France.

Originally published on cherry.xyz