Beyond the ICO: methods to achieve more optimal token distribution

The ICO market in 2017 saw approximately $5.6 billion raised in capital, as small teams of developers had immediate access to a global pool of capital and were able to finance their software startups with relative ease.

As more and more scams were able to raise unprecedented troves of money and largely retail investors were burned, regulators started taking note. Generally, pre network utility tokens were deemed securities and legal frameworks such as the SAFT were created to mitigate the legal ambiguity. The SAFT has since shown to have its own structural flaws, as financing rounds have reverted to the traditional early stage financing model dominated by VCs and accredited investors.

Attempts to address the legality of ICOs and the recent reversion of initial token distribution rounds behind closed walls seem to have blurred what ICOs were intended to achieve in the first place: the distribution of tokens to future network participants.

Networks are in essence two-sided marketplaces, where the supply side is provisioning a product or service that is met with ideally sufficient demand. ICOs in a sense, are an attempt to “buy” liquidity. By offering cheap tokens to investors at network launch, projects attempt to bootstrap the early stages of their network through strong financial incentives.

The inherent problem with the current ICO model is that the investors providing initial liquidity by investing into the tokens are in most cases not providing utility for the network. They are buying tokens instead of earning them.

ICOs are also a mechanism to reward the initial development team responsible for bringing the network to market. It’s an important point as the development of open source software should be something that is economically viable for developers through appropriate compensation. Nonetheless, while ICOs provide an option to do so, there are also other alternatives.

Back to old school

Investors do play a key function in providing liquidity and pricing the value of tokens within a network. However, generally a problem within the context of crypto networks is the concentration of wealth. Wealthy entrants have the ability to buy large stakes of cheap tokens early into the lifecycle of a network, an advantage that gets compounded considering the greater returns on capital than labor. New token engineered models need to be constructed that place a greater emphasis on labor than capital, to ensure that the participants providing work for the network are the ones receiving tokens as compensation. That process begins with the initial distribution of tokens.

There are new models of ICOs that attempt to improve on the shortcomings of the current model. Interesting developments with interactive coin offerings are attempts to achieve more optimal outcomes.

Equally interesting is to take a look back at how some of the pre-ICO networks were spawned. These “old-school” mechanisms combine rewarding the initial development team with mechanisms that created a network of users.

Equity Investment (Zcash)

The Zcash Electric Coin Company (Zcash Company), a U.S. LLC comprised of the development team behind Zcash, first funded itself through a $1M equity round. The initial equity check was used to pay for the salaries of the team and setup costs of the company.

When the Zcash software was released to the wider public, the creation of new tokens, just like Bitcoin, was in the form of mining rewards. Participants that provided the necessary hardware to secure the network were remunerated for their work. The initial token supply was 0. Tokens were released in the form of block rewards as transactions proliferated across the network and blocks were upended to the blockchain.

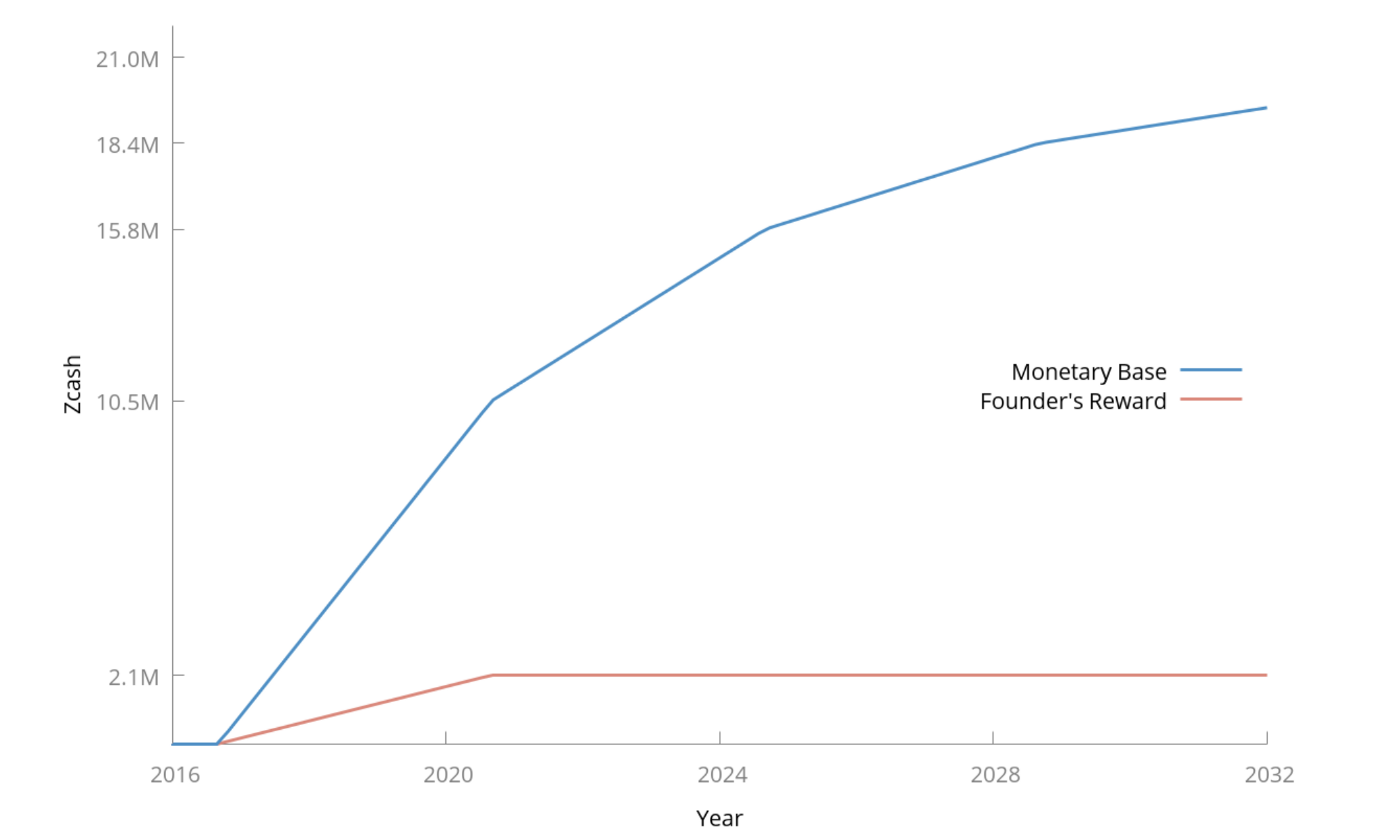

To fund the ongoing efforts of the Zcash Company working on the protocol and generate a return for the initial equity investors, 10% of the block reward will go to stakeholders of the Zcash Company as the Founder’s Reward.

With this approach, the team was able to financially support itself through external funding prior to launch, and will continue to finance its work post launch, through the generation of tokens on the basis of functional software.

Investors earned a return through the initial equity investment, which was a claim on a company that will eventually sit on 10% of the token supply. For example, if the investors cumulatively purchased 20% of the company with the $1M investment, they would sit on 2% of the token supply.

Airdrop (Decred)

The team behind the initial development of Decred, Company 0, funded itself out of pocket initially. No outside capital was raised as the team supported itself with personal funds until launch. In order to compensate itself for the work done to get the network to the point of launch, the team performed a pre-mine: 8% of the total supply of 21 million coins, totalling 1.68 million coins, was pre-mined. The contributing developers either purchased tokens at a rate of $0.49/coin or exchanged them for work performed at the same rate.

The pre-mine was split in half such that 4% went to Company 0 and the other 4% were given to early network participants in the form of an airdrop. Company 0 in aggregate purchased 840,000 coins (1.68 million / 2) at $0.49/coin, totalling a purchase price of $415,000. The other half was divided equally amongst a set of airdrop participants.

The airdrop enabled the network to further decentralize the distribution of coins and facilitate the distribution of coins to people that were interested in participating in the project.

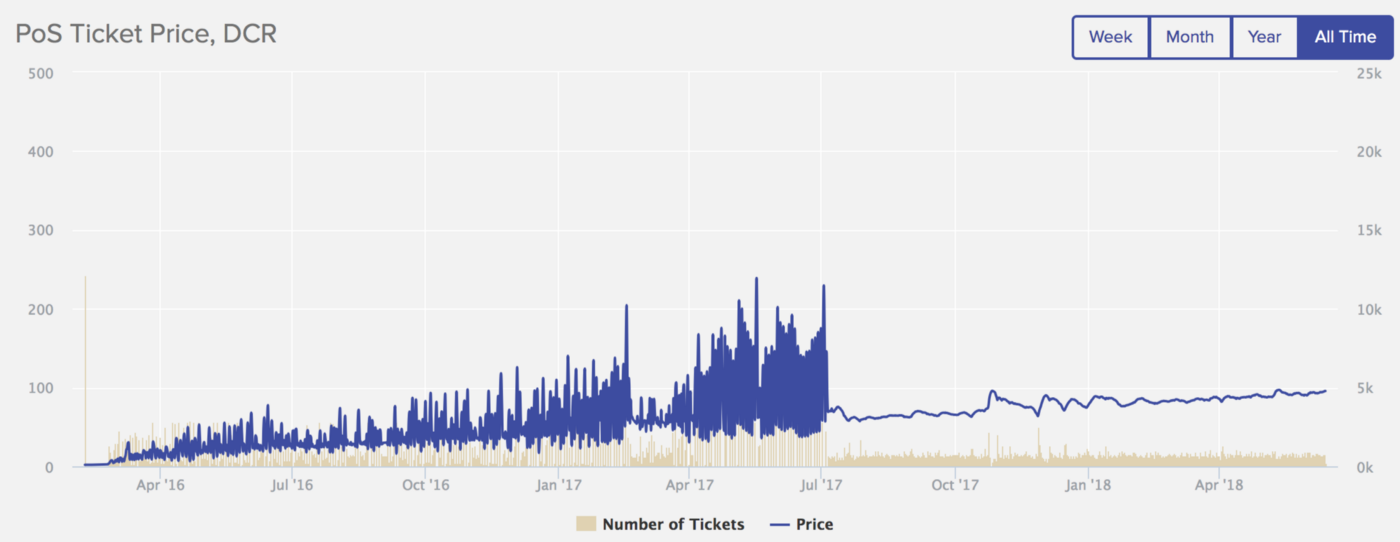

The result is a network that has a remarkably high participation rate. Approximately 47% of total tokens are staked to participate in the POS consensus algorithm currently, as the price of tickets needed for staking has been rising steadily.

The OG (Monero, Bitcoin)

Monero very much followed the Bitcoin model of releasing fully functional software into the wild without any prior funding or pre-mine.

Its provenance is extremely interesting in that it came into existence through a series of forks within a short period of time. Bytecoin, was the first implementation of the privacy-centric Cryptonite protocol. When the community discovered that 80% of the token supply was pre-mined, a user by the name of thankful_for_today forked the network and launched Bitmonero. A couple days later when he proposed changes that the community did not agree with, 7 community members forked Bitmonero and launched Monero. The 7 initial members still constitute the core development team of Monero today.

In Monero’s case, just as with Bitcoin, there was no pre-mine or founder’s reward. No equity investment either. Monero’s PoW algorithm is, however, designed for use in ordinary CPUs and GPUs. Similar to Bitcoin, especially in the early days, the ability to mine tokens directly with a personal computer, enabled the development team and early participants access to cheap tokens. However, instead of cheap access in terms of buying tokens, tokens were cheap in the sense that the hash rate of the network was low and participants were able to accumulate block rewards with low capex. Tokens were earned relatively cheaply through providing security for the network, instead of purchased cheaply.

Conclusion

These are just some specific case examples of alternative token generation methods to ICOs. They are not archetypal standards as there is no one model fits all solution. Different networks set out to incentivize different behaviours and achieve different things. These examples do serve as a reminder that projects managed to fund themselves and grow a network of users before ICOs came into existence. Ironically these are all mechanisms that arguably do a much better job in avoiding the legal ambiguity associated with most token launches today. There is no need to over-engineer legal agreements when the best cover against legal ambiguity is to put the focus on earning tokens instead of buying them, through fully functional software. Wisdom can be drawn from these old-school token distribution methods that attracted engaged participants and grew networks organically.

Originally published on Medium.