On risk symmetry and code is law

Skin in the game is a foundational concept in the context of crypto networks. Stakeholders have skin in the game through owning tokens of monetary value, and are as a result financially incentivised to collectively work for a network. Its a powerful concept and a means to ensure risk symmetry, which is the notion that when people take on risk , they are directly exposed to both the potential upside and downside. That is, downside risk can’t be arbitrarily transferred to somebody else when it feels right. You own your risk.

In a well-designed crypto network, token holders are held directly accountable for the actions they take. The reality is that programming incentives structures that function as intended and enforce risk symmetry is hard. Work tokens already offer an improved design to the first generation of medium of exchange tokens. In the work token model, a service provider stakes the native token of the network to earn the right to perform work. Quality work is rewarded with an additional cash-flow and return of the initial stake, while bad behavior is punished through the slashing of the initial stake. Still, increased granularity needs to be put into network design to ensure that incentive structures play out and risk symmetry is maintained.

Increasing symmetry of stakeholders in financial systems

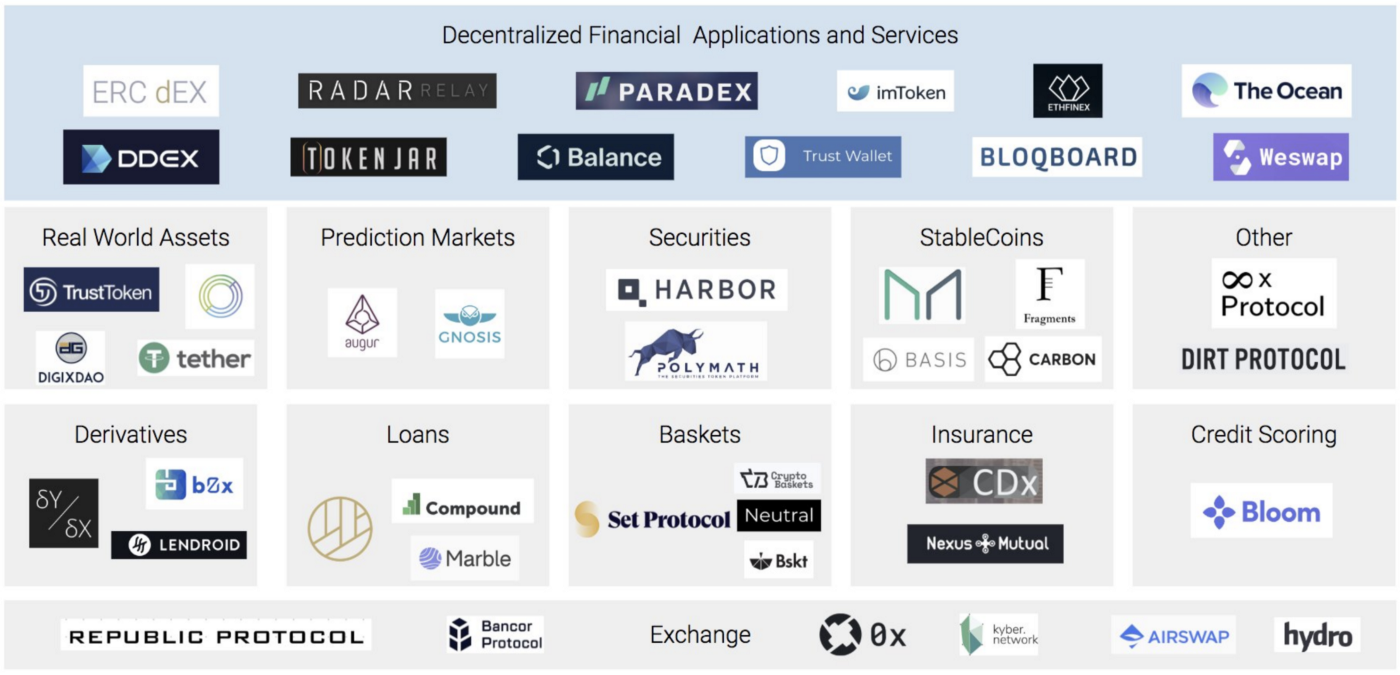

One particularly interesting area within crypto is the development of an open financial system that attempts to remove some of the structural flaws in today’s system.

As laid out in Nassim Taleb’s book Skin in the Game, financial institutions today have an ability to take enormous risks to generate upside, but are largely insulated from the potential downside. The 2008 Global Recession is a prime example. Banks were able to extract substantial profits from their high-risk, subprime mortgage backed securities, but the cost of the ensuing crash was transferred to taxpayers that bailed them out. The transfer of risk in the current system creates an environment whereby risk-taking is not matched with appropriate downside exposure.

An argument can be made that decision makers at financial institutions such as top management, board members and larger shareholders with governance rights, do in fact have skin in the game through equity or options. While that may be true, the asymmetry between this group of people and the average tax payer is worth paying attention to. Top management at a bank can participate in the large upside of excessive risk. The average tax payer, however, has no way of participating in that upside and carries the downside risk through multi-billion dollar bailouts derived from tax money.

There is still some way to go before a reasonable claim can be made that decentralized financial networks at scale solve for the problem of risk symmetry. A lot of the networks are still very young with token models yet to be more formally designed. An example of a crypto network that has, however, done a really interesting job is the MakerDAO network.

MakerDAO: A financial network with accountable decision makers

MakerDAO is a dual-token financial network that employs a stable coin, Dai, and a governance token, MKR.

Dai are created when users lock up collateral in a collateralized debt position (CDP), and take out a loan denominated in Dai.

MKR holders serve as a decentralized risk management community. They decide on several parameters that ensure the robustness of the network. In exchange for their services, MKR holders are rewarded in fees. When users want to close a CDP, they pay interest on the Dai-denominated loan taken out in MKR tokens that automatically get burned by the system. The burning of MKR tokens enacts deflationary pressures on the token supply, which increases the price of tokens in circulation. Cyrus from Scalar Capital provides a really good overview of the design here.

One of the key responsibilities of MKR holders is to decide on which tokens to accept as collateral when users open a CDP. Currently only ETH is accepted, but this will change going forward. Allowing too many low-quality, highly volatile coins to be used as collateral, for instance, increases risk in the system. This is the pre-2008 crisis equivalent of investment banks packaging up an increasing amount of subprime mortgages, thereby hiding risk, and selling them on as premium products.

If large amounts of CDPs become undercollateralized as a result of the increased volatility, an automatic recapitalization is triggered through forced MKR dilution. The system automatically mints new MKR and sells them on the market to raise money and recapitalize the system. MKR holders get diluted, effectively decreasing the value of their existing holdings.

Additional risk introduced into the system by MKR holders is distributed symmetrically.

Accepting more coins as collateral could open up the market to more potential users, thereby increasing fees that MKR holders receive. On the flip side, adding more coins also increases the likelihood of events that could adversely affect the MKR token price. Either way, MKR holders are directly exposed to the outcome of their decisions.

A bailout through token purchase incentivization

The bailout mechanism through forced MKR dilution is interesting because it bails out the system through the minting of new tokens. When newly MKR tokens are put up for purchase to recapitalize the system, existing holders, can, and are actually incentivized to purchase the newly minted MKR tokens to mitigate dilution. A bailout in this system does not rely on the transfer of debt. Somebody else isn’t left to pick up the check at a later date.

A risk this system imposes, however, is that the network is heavily reliant on sufficient incentives to purchase newly created MKR. There can be scenarios where existing MKR holders run out of funds to purchase new tokens or the incentives are not strong enough for solvent parties to invest. This is called the ruin problem, and is a general concern facing a lot of the stable coins today.

Unstoppable financial networks

It’s worth noting that in the aftermath of the 2008 Global Recession, banks were largely bailed out by their respective governments. If left to the force of free markets, more banks would have likely gone bankrupt and experienced the downside of the additional risk they put into the system. In decentralised financial networks, risk symmetry can be encoded into software. There are no arbitrary bailouts that aid in transferring risk. Risk parameters are encoded and transparent in the system. The equivalent of a government bailout in the Maker system is a piece of software the automatically executes and mints new tokens that dilute existing MKR holders.

The long-term repercussions of this new type of unstoppable financial infrastructure are yet to be seen. History has shown that new technologies are a double-edged sword. Julien Genestoux sums this up perfectly in his post Unstoppable:

“Paradoxically, crypto networks can help save us from ourselves by mitigating the influence of corrupt political and financial officials, but this very characteristic can simultaneously lead us down a path of self-destruction and enslavement.”

What this highlights is the importance of inclusion and transparency in the governance of crypto networks. If decision processes are opaque and driven by closed circles, they will likely be exploitive rather than liberating. “Code is law” is only as liberating as the degree of openness in the development of code.

So what?

It is early days in building out this new financial infrastructure. Well designed systems have the potential to create a much more fair and efficient financial system. They also come with a great deal of responsibility. Financial service providers built on this infrastructure cannot hide risk. The good actors will stay in business, the poor ones will be out of business. These are the ingredients for unprecedented innovation in open financial services and ultimately empowerment of users.

Originally published on Hacker Noon.