Improving network incentives through work tokens

The emergence of firms such as Uber and Airbnb showed that true value is in a network of users rather than in the value of physical assets. However, the majority of value creation in centralized networks is accrued by middlemen rather than distributed to the entire network. A structural flaw in the current economic construct of the firm is that most employees simply earn a salary, but are not shareholders. Uber has a current valuation of $70 billion dollars, the majority of which is captured by Uber’s leadership team, early employees and investors. This posits a misalignment in incentives as most people are not incentivized to work collectively for the long-term health of the firm, as they do not directly benefit in the upside.

Decentralized networks coordinated through a cryptographic token provide a solution by distributing network value through token ownership. Individuals own a % of total network value proportional to their token holdings, which aligns every token holders interest in collectively working towards the benefit of the network.

Utility Tokens Coordinating Decentralized Networks

The majority of utility tokens issued during the 2017 ICO boom were medium of exchange tokens.

Medium-of-exchange tokens: tokens grant participation in a network and their provisioning serves as a medium of exchange (proprietary payment mechanism) for the delivery of a good/service native to the particular network.

- Examples: Golem, BAT, Civic

While their impact was profound in that they facilitated the emergence of open networks whereby participants became actual holders of network value, they do not adequately address the issue of free-riding.

Holder of medium of exchange tokens benefit from an appreciation in network value without having to actively work for the network. Work tokens are a new construct in that they punish bad behavior and disincentivize free-riding.

Work tokens: tokens grant access to the network and provide cash flow potential conditional on the provisioning of work with the token.

- Examples: Numeraire, REP (native token of the prediction market Augur), Ether (after switch to Proof of Stake)

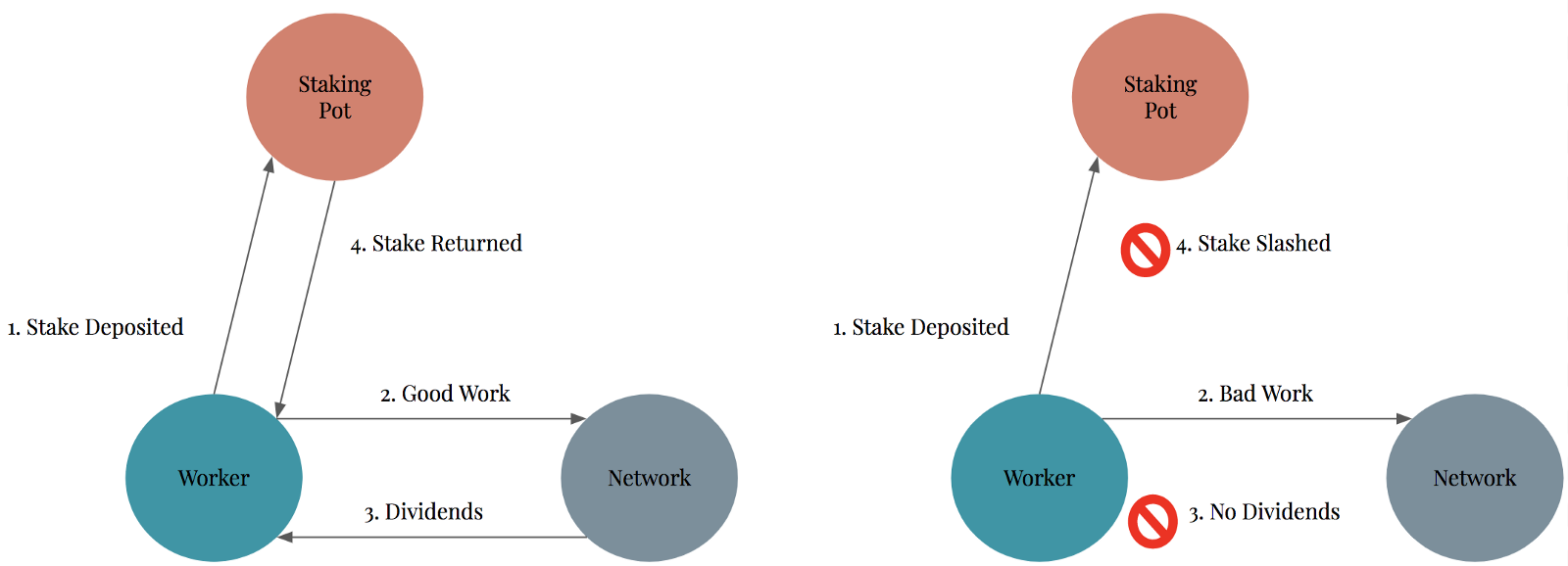

In the work token model, a service provider stakes the native token of the network to earn the right to perform work. For example, owners of Augur’s native token REP, earn cash flows by reporting the outcome of certain events that were wagered on and in return earn a % of the outstanding interest. POS consensus algorithms allow individuals to earn dividends through verifying blocks, by staking an initial pool of capital. Ether will be another example of a work token when Ethereum switches from POW to POS.

Staking systems incentivize good behavior as staked funds can be slashed in the case of bad behavior. If faulty transactions are approved on Ethereum by validators, or outcomes reported falsely on Augur, staked tokens will be taken away from their owners. Good work is rewarded with the return of the initial stake in addition to dividends.

Work tokens address free-riding as they only reward owners with dividends so long as good work is being produced. Holders with idle work tokens that are not put to use will neither lose nor gain tokens. They will still be able to benefit in network value appreciation without having to actively participate, but forgo cash flows opportunities, tied to token ownership, due to “laziness.”

Designing a Game of Incentives

The added incentive layer to participate in the work token model will arguably induce even stronger network effects: owners benefit from token appreciation and an increase in cash flows if network usage grows.

Work tokens have the potential to facilitate more resilient networks but some structural issues still remain:

- Still too many different token holders with diverging motives that have no intention of engaging in the network.

- Right to perform work for network predicated on token ownership, which in most cases requires initial capital for purchase.

- Liquidity of networks can induce short-term thinking.

Numerai offers an interesting approach to tackling the first two problems simultaneously: for its initial distribution it didn’t sell tokens in an ICO, but gave them away to the best data scientists. The result is that the biggest owners of NMR are also the platform’s largest users/stakers who didn’t need to spend money to acquire the tokens. Network token distribution mechanisms face a balancing act between enabling acquisition to a wide audience, whilst at the same time incentivizing actual users to hold the native tokens.

Questions still remain on how to get new participants onto the network in perpetuity, without placing large costs on token acquisition. Early network participants are rewarded with easier/cheaper access to tokens, but that threatens to create a “first-participant advantage” that centralizes power in the hands of early participants. How do you ensure low barriers to entry if people need to purchase work tokens first in order to be able to participate in the network?

The requirement of staking in order to earn the right to work in networks adds an incentive for longer-term thinking. The tying up of tokens for a variable, but prolonged period of time serves to mitigate (not eliminate) the risk of pump and dumps by individuals participating in the network. The risk of short-termism in networks can therefore be viewed primarily as a function of minimizing free-riding token holders.

Work tokens are an improvement on medium of exchange tokens as they simultaneously cut out reliance on rent-seeking middlemen while incentivizing widespread network participation. They are emblematic of the fast-paced progression made in the realm of constructing open networks. Designing decentralized networks is a game of incentives that has only just begun.

Originally published on Medium.