Exploring un(der)collateralized lending in DeFi

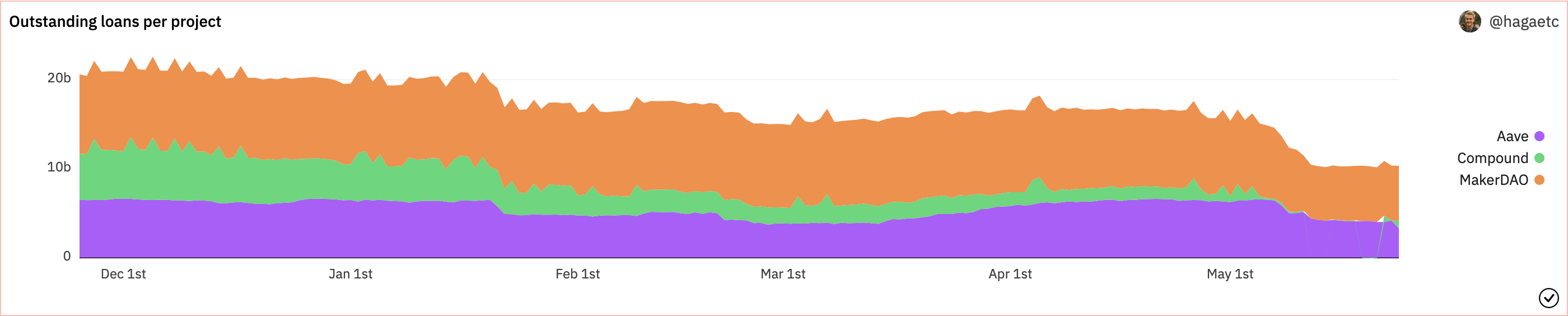

Lending markets are a core financial primitive with one of the highest adoption rates across DeFi today. The top 3 lending protocols, Aave, Compound, and MakerDAO currently have around $10B in outstanding loans.

While loan volume is one lens through which to look at these lending protocols, another is to look at TVL (total value locked). Lending markets in DeFi are open to anyone and operate anonymously. There is no KYC. To protect lenders from loan defaults, borrowers are required to post collateral before they take out a loan. TVL, a measure of the total value of capital that has been deposited as collateral, currently stands at $21B across Aave, Compound and Maker.

It’s important to note that the value of collateral provided across these protocols exceeds outstanding loan value to protect against downside volatility in the underlying collateral, which is provided in tokens. The absence of legal recourse in case of defaults requires the system to remain comfortably solvent at all times.

The drawbacks of this market structure are twofold:

- Users cannot borrow against their future as loans need to be fully collateralized upfront

- Capital inefficiencies as collateral is often idle and unproductive

An overview of uncollateralized lending

While fully collateralized lending continues to be the preeminent lending market structure in DeFi, undercollateralized or completely uncollateralized lending is growing rapidly. The top 3 lending protocols in this segment — Maple, TrueFi, and Goldfinch — currently service around $1.3B in outstanding loans.

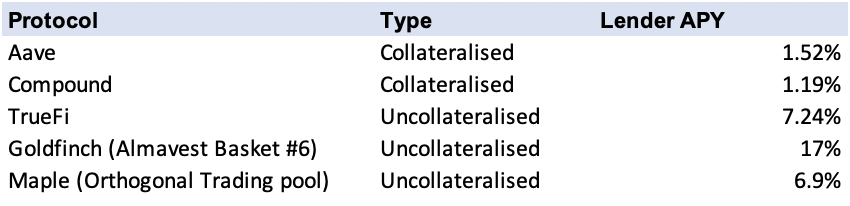

Uncollateralised lending, as the name implies, does not require borrowers to post collateral — or at least nowhere near the level of the demanded loan. It is therefore more capital efficient and flexible for borrowers but also risker for lenders, as they cannot rely on collateral that has a very established valuation in the market. To compensate lenders for the additional risk, borrowers need to pay lenders higher interest rates than on fully collateralized loans. Below is a snapshot of interest rates received by lenders across USDC markets excluding inflationary rewards (caveat, this is not a like-for-like comparison):

In the absence of immediately available crypto collateral, lenders base lending decisions on a borrower’s creditworthiness, which is typically represented through their credit score (for retail) or financial metrics (for businesses). In TradFi, defaults adversely affect one’s credit score and ability to take out loans in the future. In DeFi, loans are taken out with a wallet which is not necessarily tied to a particular person or entity that can also have multiple wallets. As a result, entirely on chain credit scores, while certainly an opportunity (more on that later), are difficult to establish. This makes it non-trivial to design a lending system that leverages the benefits of DeFi — an open and permissionless financial system — while disincentivizing borrower default.

In this post we’ll take a closer look at the leading uncollateralised lending protocols, compare their design trade-offs, and propose suggestions for unlocking further growth.

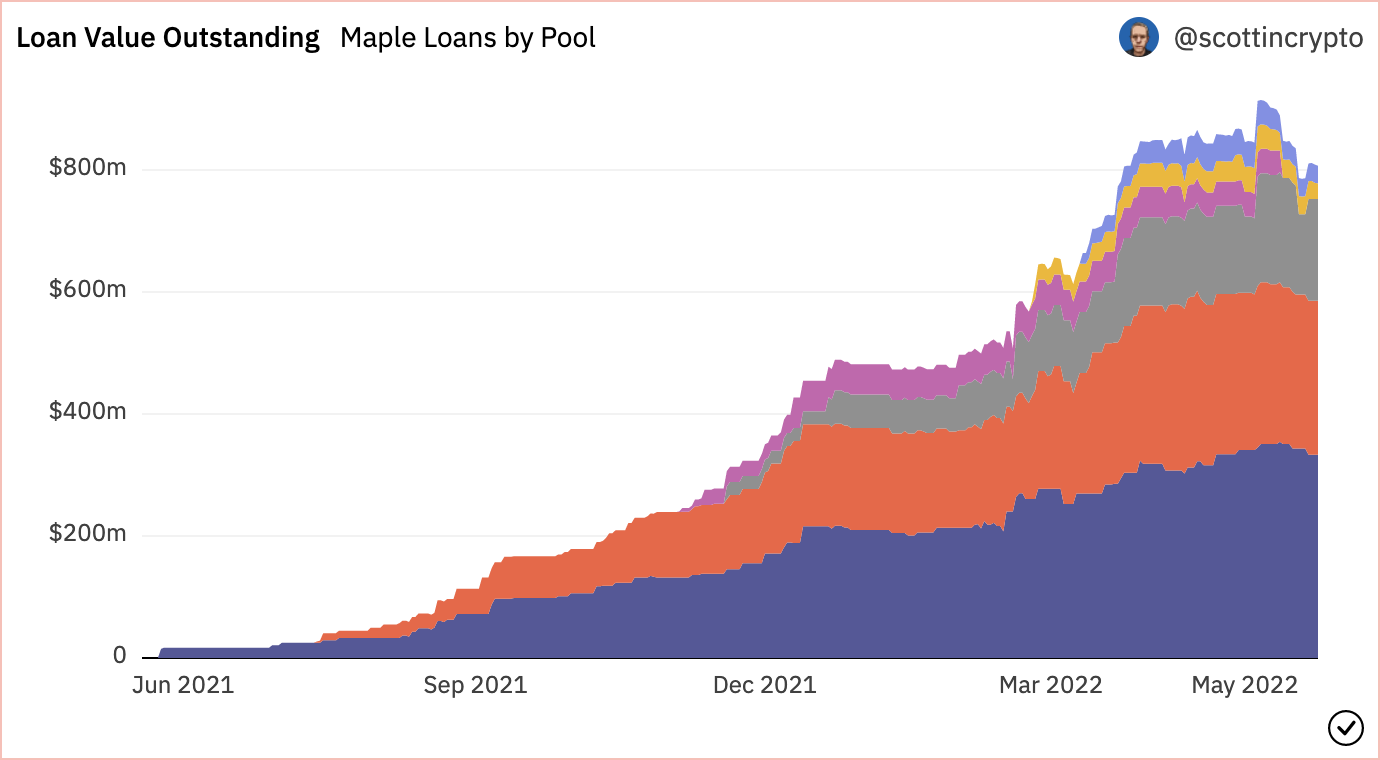

Maple

Maple is the market leader on account of active loans with $846m on both Ethereum and Solana. It has more than doubled its cumulative loan volume of $542m at the beginning of the year to $1.335B today. The majority of borrower activity on Maple comes from financial institutions that are active in crypto markets such as market makers and high frequency trading firms that borrow capital to run market neutral strategies.

Pool delegates

At Maple’s core is the concept of pool delegates. Pool delegates are institutional investors that create and manage pools of capital used to finance loans on the Maple platform. To incentivize good behaviour, these delegates post their own capital to serve as first-loss capital in case of borrower default and are rewarded with a portion of the origination and management fees on any loans they initiate. Current pool delegates on Maple include Alameda, Blocktower, and Maven11 amongst others.

When lenders use Maple, they deposit their tokens into their pool of choice, and receive LP tokens that represent their share of the pool’s principal and accrued interest in return. Lending markets on Maple are structured as pool2p (pool-to-peer) markets that allow lenders to earn interest immediately upon deposit. Lenders in the pool can claim their accrued interest at any time but have to wait for the end of the withdrawal period, a parameter set by the protocol to preserve pool liquidity, to withdraw their principal.

Borrowers come onto the platform and submit a loan request on-chain to initiate the borrowing process. Pool delegates then conduct off-chain diligence of the loan requests, which consists of an assessment of borrower reputation, management background, business strategy, and financial records. Pool delegates agree on loan terms directly with the borrowers. As a final backstop, borrowers also sign a Master Loan Agreement during onboarding which enables off-chain legal recourse in the event of default.

Default protection

Maple has native default protection provided by pool delegates and stakers. Firstly, borrowers can stake select tokens to partially collateralise their loan in exchange for lower interest rates. In addition, upon creating a lending pool, pool delegates are required to stake Maple Tokens (MPL) to their pool to serve as first-loss capital. Maple token holders can also stake their tokens to a Maple pool of choice in return for protocol fees. The staked tokens can be liquidated at any time to serve as additional first loss capital.

While Maple’s built in coverage gives lenders some form of protection, the coverage is low which means that lenders still risk losing the majority of their capital in the event of a default.

TrueFi

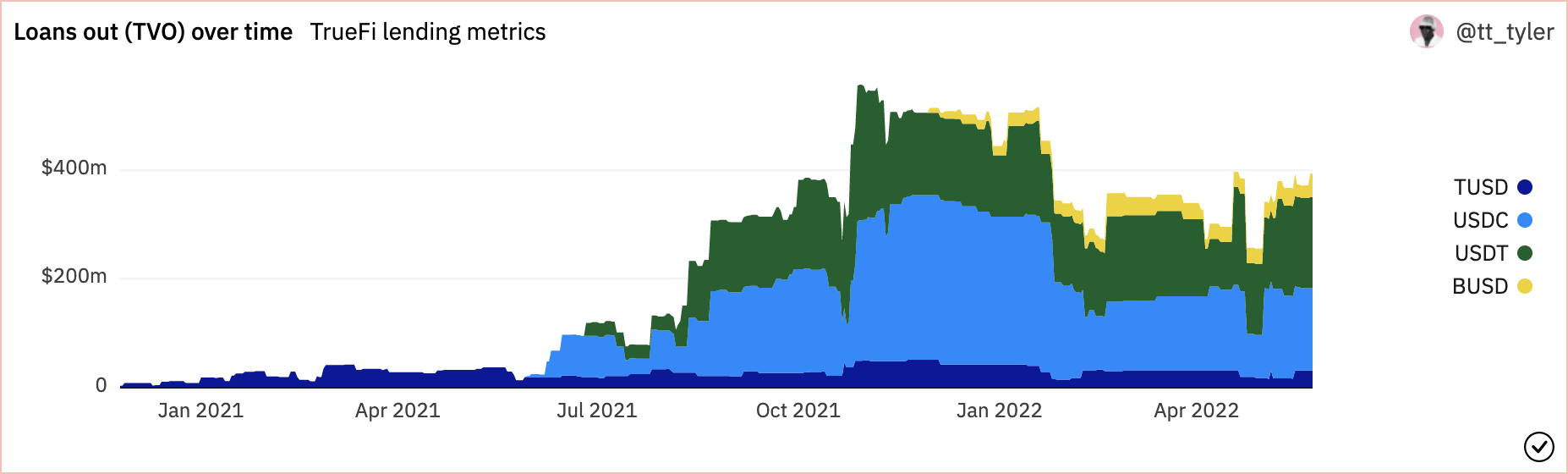

TrueFi is the second largest uncollateralized lending protocol with approximately $393m in outstanding loans. Cumulative loan volume at the beginning of the year stood at $1.062B and is now $1.59B. The majority of borrowing activity comes from similar financial institutions to those on Maple.

TrueFi pools

TrueFi is based on a similar lending pool system as Maple with the notable distinction that the loans are underwritten and managed directly by TrueFi. Structurally, it is the most centralised of the lending protocols.

When lenders come onto TrueFi they can deposit their tokens into one of the pools on offer and receive LP tokens in return. Tokens that are not lent out directly are deposited into other DeFi protocols like Aave and Curve.

Similarly to Maple, borrowers need to sign a Master Loan Agreement on TrueFi when they sign up. They then go through an off-chain loan evaluation process managed by TrueFi to receive an on-chain credit score that incorporates both on-and off-chain data. Once that process is complete and borrowers are whitelisted, they can apply for loans. TrueFi only allows borrowers with a minimum of $10m in assets to borrow on the platform.

Lenders can withdraw their stake at any time, given there is sufficient liquidity, by returning their LP tokens in return for their principal + accrued interest. In the event that the pool doesn’t have sufficient liquidity, lenders need to wait until additional liquidity enters the pool through either borrower repayments or new lenders.

Default protection

Truefi offers some built-in default protection through staking and its secure asset fund for users (SAFU). Holders of TrueFi’s native token TRU can stake their tokens to serve as first loss capital. Staking is incentivized through protocol fees and liquidity rewards in TRU tokens. In the case of a default, a portion of the staked TRU tokens are liquidated and used to cover a portion of the borrower’s position.

At this stage a maximum of 10% of the staked token pool can be liquidated to cover a single default. If the value of the defaulted loan exceeds the value of liquidated tokens, the SAFU steps in, which is an additional pool of backstop capital supplied by TrueFi.

Goldfinch

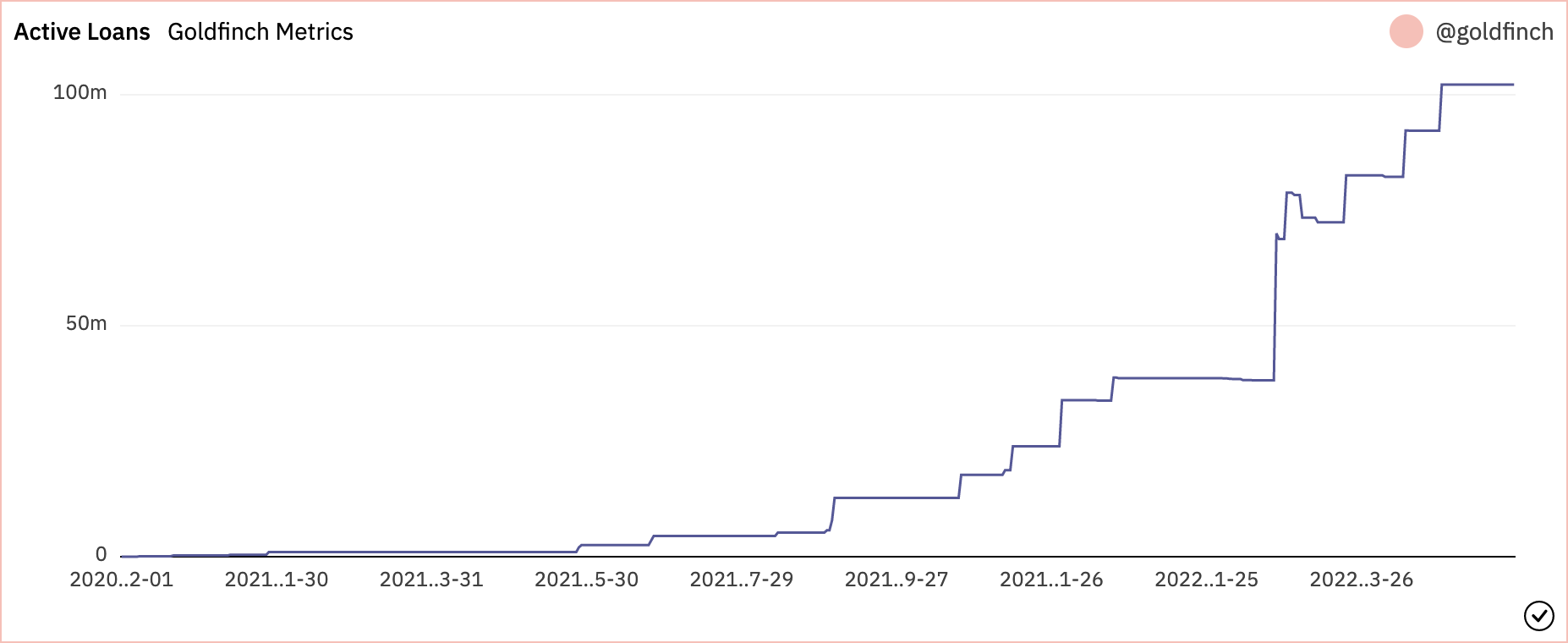

Goldfinch is the third largest uncollateralized lending protocol with approximately $102m in outstanding loans, having started the year at $38.6m. In contrast to both Maple and TrueFi, Goldfinch borrows to lending institutions in emerging markets that don’t have access to traditional sources of liquidity. Example borrowers include Payjoy in Mexico and QuickCheck in Nigeria, two consumer lending companies.

Tranching

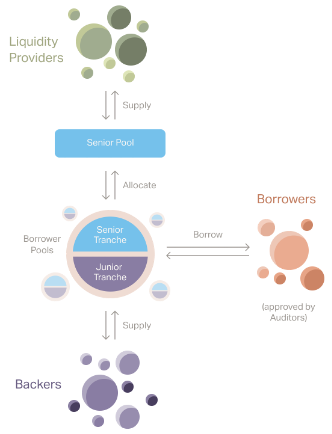

Goldfinch is structured differently to Maple and TrueFi through its use of tranches. Loans on goldfinch consist of two tranches: senior and junior tranche capital.

In loan markets, senior tranche capital receives principal and interest payments before the junior tranche. The junior tranche is higher risk but gets compensated through higher interest rates.

Before borrowers are allowed to take out loans on Goldfinch they need to be approved by auditors that conduct off-chain checks similar to Maple and TrueFi. Approved borrowers can create borrower pools, which are smart contracts that facilitate the withdrawal and repayment of capital by borrowers. They then submit loan proposals that define the loan amount and terms of their borrower pool.

Backers evaluate loan proposals and decide whether to provide junior tranche capital. Once backers have financed a particular loan, the senior tranche capital finances the remainder of the loan.

Senior capital on Goldfinch is supplied by liquidity providers that deposit capital into a single senior pool that automatically allocates capital across different senior tranches of borrower pools according to the leverage model. The leverage model uses a principle of “trust through consensus”, which means that while the protocol doesn’t trust any individual backer or auditor, it trusts their collective actions. Practically, this is implemented by allocating the senior pool based on how much capital backers have supplied to a given borrower pool: with more backing capital comes more senior capital.

In contrast to backers, liquidity providers to the senior pool don’t analyse each loan proposal individually, but rather deposit capital in order to earn passive yield. To compensate junior capital for its higher risk, the senior tranche passes on 20% of its nominal interest to the junior tranche.

Senior pool LPs can withdraw their stake at any time, while backers receive repayment of their principal and interest over the duration of an individual loan.

Default protection

Default protection on Goldfinch is provided through staking on individual backers. Backers have the ability to stake the Goldfinch native token, GFI, on each other, which acts as collateral in case of default. When a borrower defaults, the GFI staked on all the backers in that pool are reallocated to the senior tranche until the senior tranche is made whole.

Looking at protocol tradeoffs

The design choices of each protocol have their merits and drawbacks. The pool delegate system employed by Maple results in a more decentralised system with less reliance on Maple as an intermediary. Pools managed by third parties enable more efficient loan pricing as each pool can extend competing offers to borrowers. The benefit of a more centrally managed system like TrueFi is that once lenders are whitelisted and assigned a TrueFi credit score, the process of taking out loans is easier as there is just a single intermediary.

While Goldfinch also uses pools, its system differs to both Maple and TrueFi in that pools are initiated by borrowers rather than lenders. This reduces the potential window that idle capital sits in pools as they only form when a loan is made. The drawback for borrowers is that it can be more difficult to coordinate the loan as capital needs to be called at the point of loan initiation.

The main two drawbacks across each of the protocols are that 1. diligence and loan underwriting are done primarily off-chain and 2. default protection is low.

Given the absence of an interoperable on-chain credit score, the current protocols have struck a balance between TradFi and DeFi — an entirely off-chain loan evaluation process coupled with on-chain loan financing.

Default protection is both low and denominated in each protocol’s native token, which compounds idiosyncratic risk. In case of default, the native token gets sold for the asset that the loan was denominated in (mostly USDC) in order to repay lenders. If the token price falls in the meantime, coverage falls in tandem as each token is now worth less in USDC terms.

Unlocking future growth

Despite uncollateralised lending having grown tremendously over the past couple months, it is still very early. Looking ahead, there are a multitude of avenues for future growth such as going multichain and leveraging DeFi’s native composability.

Products that bring more of the loan evaluation process on-chain and allow stakeholders to better price and manage risk are key levers. Below is a non-exhaustive list of products that we think can elevate the space to the next level.

On-chain credit score: this is the holy grail. An on-chain and composable credit score that is interoperable across multiple platforms. On-chain credit scores would increase efficiency as lenders would no longer have to repeat the same checks and pricing would be based on a more comprehensive borrower profile. Individuals and businesses can build up a credit score based on their on-chain history that all protocols and lenders can tap into.

There’s interesting work being done around the concept of soulbound tokens, which are non transferable NFTs that can encapsulate an individual’s or entity’s credit score. These NFTs could sit in a user’s wallet and through guarantees of non-transferability, ensure that credit scores are not traded and truly reflective of the holder.

Generalised default protection: default protection that is agnostic to lending protocols. The current approaches only allow for lenders to get coverage from the same protocol that they are lending on. Generalised, portable, default protection would allow lenders irrespective of lending protocol to take out insurance and incentivize first-loss capital providers with more diversified exposure to yield. It would also allow for better market discovery of the underlying credit risk.

Cross protocol LP swaps: once lenders have deposited their capital into lending pools they cannot actively trade their position. They either keep their stake in the pools or wait for the lock-up periods to elapse and withdraw. A liquid, secondary market for LP positions in lending pools would enable real time pricing of positions and give lenders more tools to manage their risk.

Structured products: once active lending positions are accurately priced and liquid, structured products can be created that pool multiple undercollateralized positions together. Investors can then receive diversified exposure to loans issued across the different platforms through a single product.

Originally published on cherry.xyz