Bio DAOs

If you’re spending time exploring the DeSci space, one of the first things that will jump out is the vibrant ecosystem of Bio DAOs across multiple fields of science - VitaDao for longevity, HairDao for hairloss, AthenaDao for women’s health etc. What you’ll also notice is that it’s notoriously difficult to receive a precise and consistent definition of a Bio DAO - ask 10 people and you’ll probably get 10 different answers.

What is a Bio DAO?

I think the reason that it’s difficult to define a Bio DAO is because they aren’t a singular concept but rather a bundle of related concepts. Below are what I consider to be the core concepts.

Community

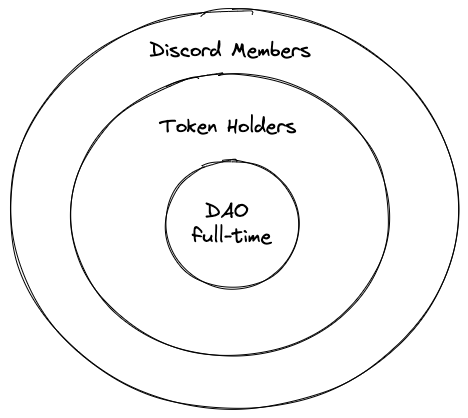

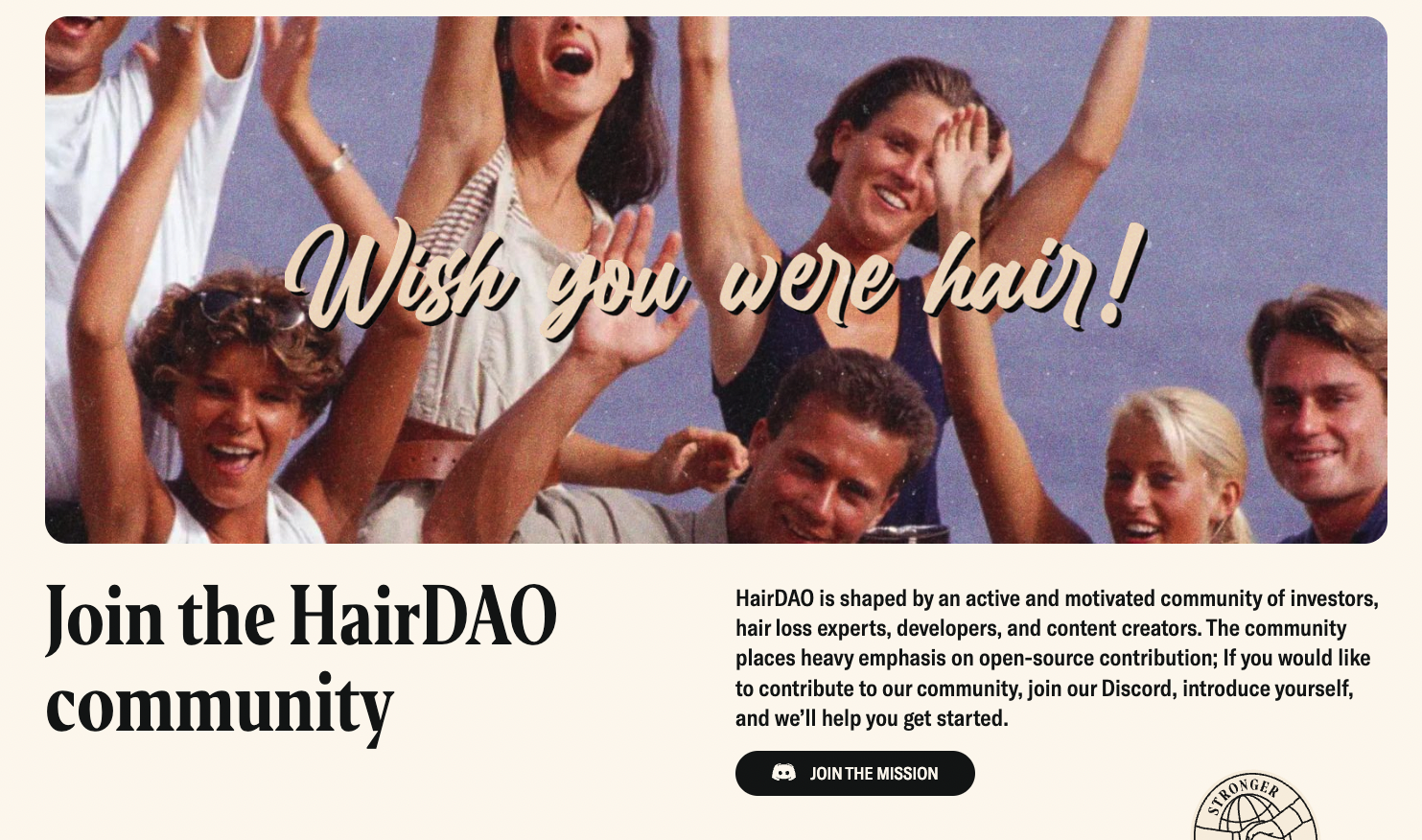

First and foremost, Bio DAOs are communities of patients, researchers, entrepreneurs and investors that rally around a particular field of scientific research. DAOs more generally are open structures that anybody with an Internet connection and a computing device can join. The organisational structure of most Bio DAOs consists of several layers.

The outermost layer is community members that joined the DAO by way of entering its main social platform that functions as the communications hub. Depending on the target audience, Bio DAOs choose different platforms. Discord is the most popular option today, but other options include Reddit and Telegram. Given the ease of which membership is expressed, there is naturally a large degree of variance in the involvement of members at this layer.

The second layer is holders of the DAO’s native token, which can either be bought or earned by providing work for the DAO. Tokens represent ownership in the DAO and are used to vote on internal matters, the most notable being treasury allocation. Unsurprisingly, there are fewer token holders than discord members. Vita DAO as an example, has 9,000+ members in its Discord but only around 1,400 token holders.

The innermost layer is a core, usually small, set of members that work on the DAO full-time. Vita DAO has just around 10 FTEs.

DAO members get involved for a variety of reasons. Patients may get involved because they want to learn more about the disease they are suffering from and exchange knowledge / best practices with other patients. Researchers have an avenue to seek collaboration with other researchers and can access a patient base to involve in their research. Entrepreneurs developing therapeutics have a direct channel to their customer base and investors can be all of the above or simply people betting on the token price to rise.

Investment

Bio DAOs are also investment firms but differ from more classic organisations like VCs in that they are entirely open for anybody to invest in.

Bio DAOs raise capital through primary issuances of their native token. For example, VitaDAO launched its token in the summer of 2021 through a Gnosis Auction that was available to the public. The proceeds of that token sale went into the treasury which has since largely been used for investments across the longevity space. One of those investments, was a $1m equity cheque into Turn.bio, a company that uses mRNA technology for skin rejuvenation.

Profits generated from the eventual sale of investments are recycled back into the DAO treasury.

IP incubation & development

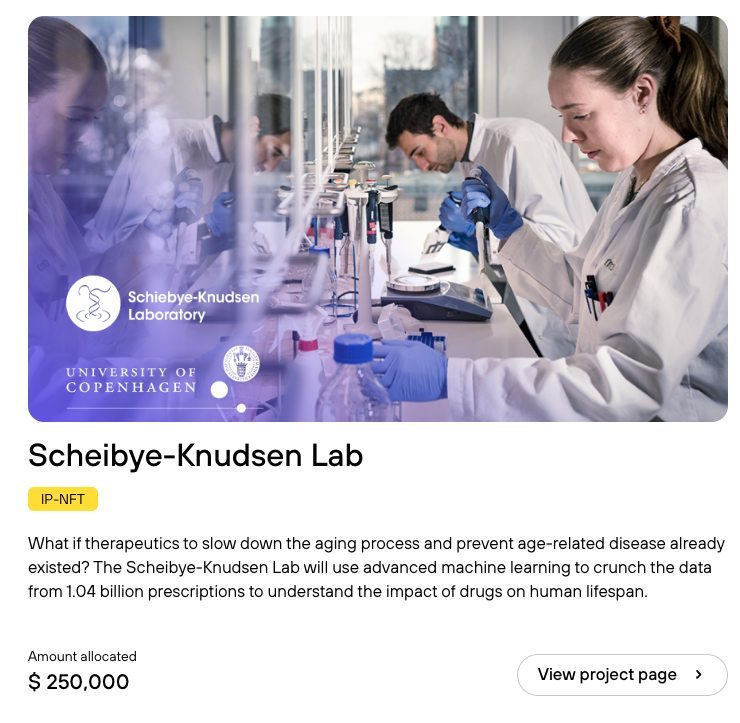

In addition to investing into existing companies, Bio DAOs incubate and develop IP themselves. This is a much earlier stage in the development cycle of a potential therapeutic.

In these cases, Bio DAOs acquire 100% or a majority stake of a given IP. Once purchased, the researcher or group of researchers developing said IP work under the umbrella of the DAO, where they receive support from the community of patients, academics, entrepreneurs, operators.

VitaDAO was the first Bio DAO to acquire the IP of a research lab, the Scheibye-Knudsen Lab, through a $250,000 investment in June 2021.

If a particular piece of IP can be commercialised, the team could spin out of the DAO and form a separate company. The DAO would retain a commercial tie to that IP either through an equity stake in the ensuing company or a licensing agreement for the IP.

Data

Bio DAOs are also fertile ground for the creation rich of datasets. The convergence of patients with researchers and token incentives is promising. For example, AthenaDAO could build the world’s largest dataset on female health, and HairDAO the most comprehensive dataset of hair treatments. DAOs can further incentivize the collection of data from its members by offering tokens in exchange. It would not be surprising if DAOs manage to build the world’s largest medical data sets in certain areas of research.

Accelerating scientific progress

So why are Bio DAOs actually important and how can they improve science? If science is the iterative process of learning more about the truths of our world, how can Bio DAOs make that process more efficient?

Open collaboration

DAOs are inherently open organisations instantiated entirely through software. This enables them to scale much more effectively than centralised companies. As I wrote in DAOs - scaling capital coordination:

“DAO members are not incentivized to work for a DAO through formal work contracts but rather through an incentive to maximise the value of their token holdings. Through open organizational structures and economic incentives, DAOs can pull together resources from all over the world without the necessity of contracts and formal working relationships. This makes DAOs highly capital efficient and allows them to scale to the level of their LLC counterparts at a fraction of the cost.”

Bio DAOs are melting pots of talent and ideas that contribute to innovation across the sciences. In a sense they’re the Bell Labs of biotech. Bell Labs was the research arm of AT&T for most of the 20th century and is credited with some of the most important technological developments in history including the transistor, the laser, the Unix operating system and multiple programming languages.

The difference is that Bell Labs relied on the work of its employees that showed up to the office in New Jersey. Bio DAOs can rely on the work of anyone on the Internet.

Incentivized patient groups

The direct collaboration between researchers and patients has historically demonstrated that it can lead to big breakthroughs. The polio vaccine and Cystic Fibrosis Foundation both emerged from the collaboration of researchers and patients.

Accessing patients and patient data is one of the most cumbersome and expensive stages of research. That’s why providing a shared setting for both patients and researchers is so powerful. It can make research much more efficient and cost effective.

Bio DAOs go one step further than traditional patient / researcher structures by adding economic incentives. If patients participate in research, not only do they potentially get a therapeutic, but they also participate in the potential economic upside of that therapeutic.

Capital with different demands

The primary funders of scientific research today are governments and VCs. Both sets of institutions are important but also have their limitations. Governments continue to primarily invest in areas that are most visible and avoid research that pushes against the status quo. VCs need to pick investments that will play out over their fund lifetime of 10 years and accordingly focus on research they believe can be commercialised in that time fame. The particular demands of governments and VCs means that some areas of science have been overlooked and underfunded.

Bio DAOs are a different source of capital with different demands. Bio DAOs enable the crowd - patients, researchers, academics, entrepreneurs - to invest in the causes they want to see funded. The patient owned structure of Bio DAOs increases the probability that long term innovation gets prioritised over short-term profit maximisation. Patients prioritise investments that have the potential to solve their condition versus attempting to make a quick buck. It’s also no surprise that Bio DAOs have cropped up in areas that tend to get overlooked by traditional institutions but have impassioned patients looking for cures - rare diseases, hairloss, women’s health etc.

Whats next?

While the early signs of Bio DAOs are promising, there are still a lot of questions that need to be answered. First, we’ll need to see if Bio DAOs can actually develop valuable IP.

I think we'll see more innovation in token design because most tokens today are just used for voting. Profits generated from investments flow back into the treasury and cannot be distributed out of fear that tokens could be deemed a security. As a result, the value of a token only rises according to the perceived value of governing a growing treasury. My guess is that if these tokens did give holders the rights to investment proceeds, Bio DAOs would be able to accumulate much more capital. It’s a tough line to walk though as securities are much tougher for investors to purchase and would exclude a portion of people from participating.

As for token voting itself, it’s clear that voting based entirely on token holdings is not ideal. Especially in the context of Bio DAOs, where investment decisions into IP or biotechs require a lot of technical expertise, it’s unlikely that the people best placed to make decisions are those with the largest token holdings. I’d like to see a lot more experimentation around reputation based voting systems.

Bio DAOs are currently in their first iteration and I'm sure we'll see a lot of experimentation in search of their most optimal structure. Yet they are already enthralling a generation of patients, researchers, entrepreneurs and investors on a mission to improve science.