Unlocking Bitcoin

Bitcoin, the oldest and most valuable crypto network, is experiencing a renaissance. Over the past few months there’s been a public market rally of the Bitcoin network’s native token, BTC, and the release of the first BTC spot ETF, which has been the fastest growing ETF in history. However, the renaissance I’m referring to relates to the interest and activity around building additional layers and applications atop of Bitcoin.

Historically building directly on Bitcoin has been difficult. The language used to program on Bitcoin, Script, is not Turing-complete, meaning it's less expressive than Turing-complete languages like Solidity and Rust which are used to program applications on other blockchains such as Ethereum and Solana respectively.

This was an intentional choice for Bitcoin. Bitcoin emerged out of the 2008 financial crisis with the intention of creating a new form of money, which meant that minimising the surface area of attack was the priority. Turing-complete languages, while more expressive, introduce more vulnerabilities that can be exploited by hackers.

Over the years, while other blockchains such as Ethereum and Solana positioned themselves as multi-purpose global computers, BTC increasingly came to be viewed as digital gold. Valuable, but not to be used. Today most BTC is locked away by its holders.

There’s nothing wrong with that in my view as there is a lot of value in a product that serves as digital gold. However, I am also excited by new opportunities that allow holders to put their BTC to more productive use.

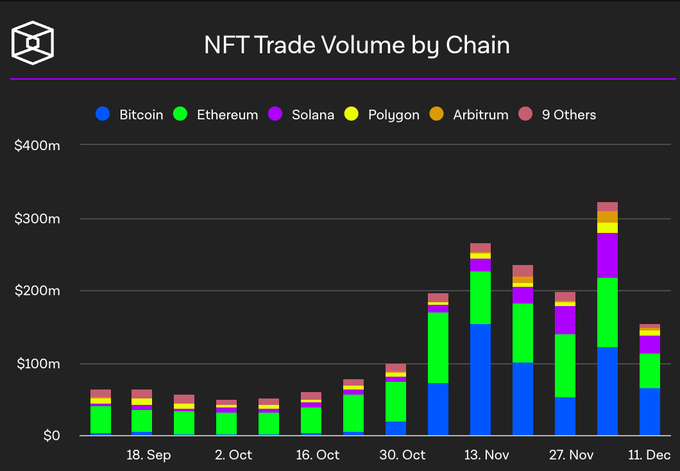

While there have been attempts to build on Bitcoin in the past, success has been limited. More recently, however, a succession of technical upgrades - SegWit and Taproot - have enabled a host of developments such as Ordinals, Bitcoin’s version of NFTs, and BRC-20 tokens, the standard for fungible tokens on Bitcoin. Ordinals in particular, have generated a lot of traction and renewed interest in the Bitcoin ecosystem. They were launched in March 2023 and have since catapulted Bitcoin to one of the largest blockchains in terms of NFT volume.

At the same time, there has been a proliferation of Bitcoin Layer 2s. Bitcoin L2s are computational layers on top of Bitcoin that make it more programmable, enabling smarts contracts, a DeFi ecosystem and other products that couldn’t be built directly on Bitcoin. Stacks and BOB are two of the front-runners at the moment, each having grown to over $100m in TVL. The emergence of a DeFi ecosystem on top of these L2s allows holders to put their BTC to more productive use and earn yield on their holdings.

Looking ahead, the release of the much anticipated BitVM will enable even more expressivity and new applications, as it will bring Turing-complete smart contracts to Bitcoin for the first time.

An important aspect that still requires more work, however, is ensuring that BTC can be moved safely across the different layers and applications on top of Bitcoin. There’s a delicate balance to be struck between expressivity and security. Given the culture surrounding Bitcoin and its uncompromising stance on security, upcoming applications will need to provide holders the highest degree of safety in order for them to feel comfortable utilizing their BTC.

I ultimately don’t think Bitcoin will see the same wide range of applications emerge as on a multi-purpose blockchain like Ethereum. However, Bitcoin has BTC, crypto’s highest value asset. Unlocking that BTC seems like a big opportunity to pursue.